From chips to chivdas, from biscuits to bakharwadis and from momos to murukku, Indians have always loved their snacks, let alone the festival specific snacks / farsan.

However, off late people have been a bit more conscious of what they are eating and a whole new category of Healthy Snacking has evolved. Pivot from white bread to brown bread, increasing emphasis on consumption of oats / muesli /quinoa as a breakfast option and wider acceptance of products made of healthier ingredients including ragi, barley, etc.

Direct-to-consumer (hereafter D2C) healthy snacking brands are on the rise given the increasing consumer demand. 25+ startups, c. USD 100 mm raised; and cumulative FY20 revenue of INR 4,500+ mm, prima-facie these are decent numbers. Direct to consumer as a concept is already seeing a lot of traction and it is a matter of time that D2C Companies in the healthy snack space start experiencing significant tailwinds. Furthermore, FMCG giants are also joining the healthy snacking bandwagon. Nestle is committed to cut salt by 10%, sugar by 6% and fat by 2.5% whereas Britannia stated that it would reduce sugar by 5%

Key factors around the food business in India (or for that matter anywhere) are:

- Taste: Taste stills seems to be of paramount importance for Indians. Unless the brand appeals to the palate of its target consumers, it will remain sub-scale no matter what its provenance. For example, sour cream and onion may be the rage abroad but India still loves the “Chaat” type flavours.

- Price: Price is critical and options available are many. Indians can even now snack cheaply- how much does a serving of street-side bhelpuri cost after all? It is challenging to make a compelling case for a Rs 80/- packet of a snack-food when a burger is available for Rs 60/-.

- Place and form of consumption: How and where people are eating is a key change that is emerging as India navigates its way out of Covid. The food business in general is moving up the value chain - e.g., packaged pre-cut vegetables, processed meat, packaged idly dosa batter, pre-made rotis. Many of such changes have already gained large-scale traction- Zomato’s traction is a bellwether for one such evolution. There will be many more in the years to come as consumers evolve in the post-Covid world. Quite apart from evolution of the space where food is consumed there will be fundamental changes in the “how” of eating and we think this will lead to accelerating movement from “raw” food towards “ready-to-eat” in product offerings. For example, in the sweet-corn based snacks we are seeing a move from the simple “corn on the cob” towards spoonable cups as the customer preferences evolve.

We are excited about the prospects of the food business in general and this category in particular. Our thoughts on what could be some differentiators that will help successful outcomes are:

- Price. The best snack-food companies in the world have a very narrow focus on the number of “trips to mouth” that each packet of snacks will allow. Behind this is the realization that “snacking” as a category will never substitute the primary meal. The felling of satisfaction from eating is thus largely psychological. The value proposition is hence critical as the eater should be left with a happy feeling about the quantity that they got for the money spent. This concept has implications on packs-sizing and pricing, to start with.

- Scale and profitability are both important. More than any other sector this one punishes poor unit economics.

- Simplicity in communication. Indian consumers know what they like to eat and are generally well-informed about food. The benefits must be clearly articulated to the consumers: for example, why is a Quinoa good for you?

- Simplicity in communication. Indian consumers know what they like to eat and are generally well-informed about food. The benefits must be clearly articulated to the consumers: for example, why is a Quinoa good for you?

- Acknowledge the challenge of fresh snacks. As mentioned above, it will be challenging to make a compelling case for a Rs 80/- packet of snacks when a freshly-put-together burger is available for Rs 60/-. A chole bhature or a masala dosa (in themselves a full meal) can cost even lesser. Hence brands must closely reflect on the premium that they can command for a “health” positioning.

- A key metric to watch out is the wastage percentage. Wastage measures the loss due to shelf-life or transit damage issues that occur before the end-consumers get the final product in their hands. The ability to achieve negligible wastage is a leading indicator of efficient and flexible supply chain efficiency.

- This brings us to the most important factor for success in a food company, namely a frugal mindset among those who run the business. Great operating efficiency, flexible supply chains and low cost/wastage is the result of a frugal mindset and achieving that is easier said than done particularly if the company is well-funded and looking to keep improving valuations. We think managing this dichotomy will be key to winning in the food business.

Companies and managers have found innovative answers to all such and other question. Many start-ups and young companies are finding innovative and creative ways to further improve such outcomes, and winners will start emerging soon.

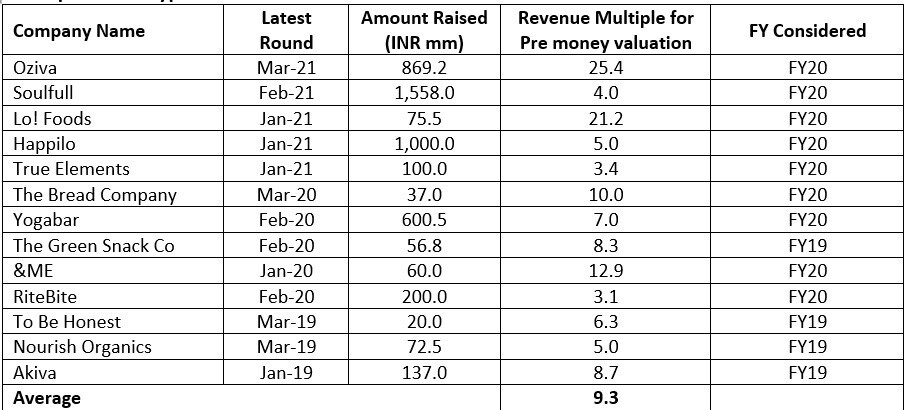

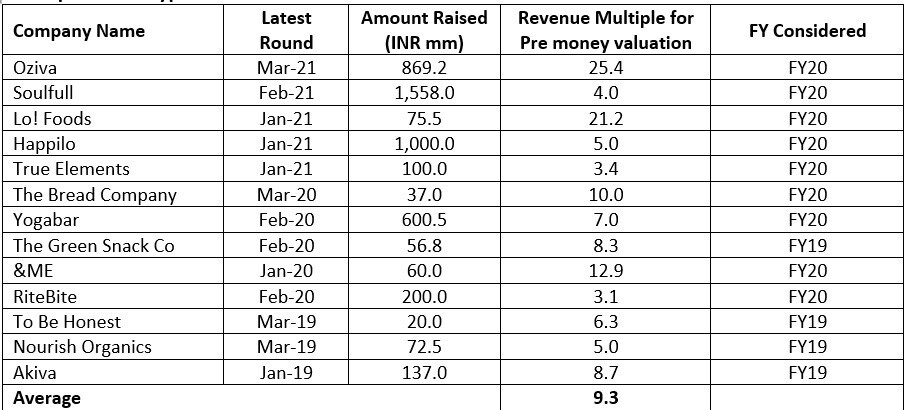

A sample of the type of deals in this sector is as below:

Some of the revenue multiples seem very rich - a sign of burgeoning interest in this sector.

What comes next for the sector?

Is taste still paramount for the Indian consumer? Are they willing to try other flavour profiles for better nutritional value?

Are large numbers of consumers willing to pay more for health?

Do companies need to increase their reach / presence beyond metro cities to tier-I and tier-II cities?

Is it all just a matter of time that a ‘too-large-to-fail” enterprise emerges as given that most of the marquee investors are getting excited about this category?

We would love to see a unicorn in the D2C snacking from among the new companies that are being born. If such a business can also forward the purpose of health and nutrition then that would be the icing on the cake (we are permitting ourselves a mixed metaphor here). It would be wonderful to hear your thoughts and comments.